how to open tax file malaysia

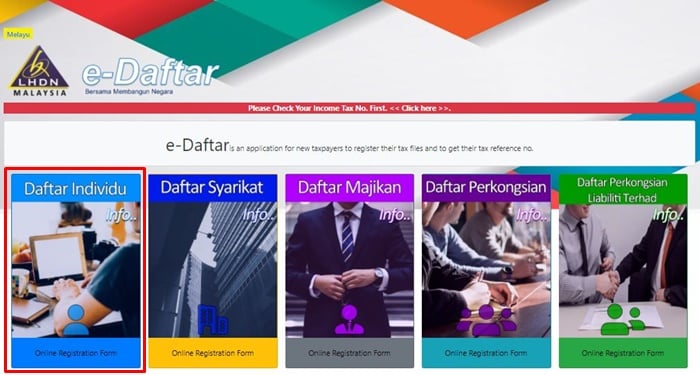

Click on e-Daftar. The process is simple and wont take you more than two hours to complete.

Income Tax Return Itr Filing Deadline For Fy21 Extended Again Details Here Mint

2Only gif File Format is allowed and the file size must be from 40k and not more than 300k.

. The following entities and accounting firms in Malaysia must file their taxes. Microsoft Windows 81 service pack terkini Linux atau Macintosh. Review all the information click Agree Submit button.

A businessperson with taxable income. Click on the e. An e-Daftar application will be cancelled if complete documents are not received within 14 days from the date of application and an applicant must make a new.

Submit income tax return Form C within 7 months from the end of the companys financial year. Unregistered companies with IRBM. Online submissions of tax returns for 2021 will be accepted beginning March 1 the Inland Revenue Board LHDN said today.

An employee who is subject to monthly tax deduction. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. If you are reading this online chances are you have already checked out e-Filing but perhaps you still need to do your parents or older family members tax returns manually.

If it continues you will be fined another 5. Once you have completed and uploaded the required documents click Submit and LHDN will provide a Pin Number for you to review the application after 7 working days. Once that is done click on Download Form E sign and submit via E-Filing.

A business or company which has employees and fulfilling the criteria of registering employer tax. If you submit late within the first 60 days you will need to pay 10 more than the tax payable as a fine. This can be done at the nearest SSM office or via their online portal.

The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30 December 2021. Now income tax registration is much easier than before. How To File Your Taxes For The First Time.

Double-check each employees Borang E to ensure that everything is in place. 3 File name must only contain Alphanumeric Characters a-z A-Z and 0-9. A video step-by-step guide to accompany our earlier post about how to file your personal income tax in Malaysia in 2019 as an expat or foreigner.

Taxpayers are advised to submit their. 2022 income tax return filing programme issued. Click on the e-Daftar icon or link.

Submit form CP204 within the first year. You are liable to file your income tax if you. In a statement it said the submission of tax return forms through e-filing for Forms E BE B M BT MT P TF and TP can be made through the official HASiL portal.

2 SSM officer will check the name availability 3 Make a payment of online registration purpose RM 60 Name purpose RM 30 and branch RM 5 only. Make sure your email address is correct because LHDN will send a reference number to your email. Click on ezHASiL.

You can register your tax file online. Heres the process in brief for a new business. Use e-Daftar and register as a taxpayer online.

If you do not hold but require an Income Tax Number you should. Scroll down until you see Muat Naik Disini where youll need to upload a copy of your Identity Card. To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website.

If youve forgotten your password click on Forgotten Password Terlupa Kata Laluan. Remember you need to register as taxpayers while registering for ezHASiL e-Filing. Login to e-Filing and complete first-time login.

Proprietorship company formations steps are 1 Fill up a form and submit to the counter of SSM to verify by officer. Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing. Youll need to submit a completed Business Registration Form Form A along with a photocopy of your NRIC permit or supporting letters if any and the required payment.

Individual who has income which is taxable. Get a PIN for e-Filing registration. Number can be seen clearly and the file must be in gif format.

The process of registration is discussed below. Fill in the required information. Next key in your MyKad identification number without the dashes and your password.

The 2022 filing programme is broadly similar in concept to the position laid out in the original 2022. If you dont want to end up making more trips to the tax office than necessary its best that you are thoroughly prepared first. However if you havent registered a tax file and your income is below the chargeable amount you dont need to register a tax file.

1 you can now register Tax File and Employer File online via e-daftar on LJDN website. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. You can click on the feedback button and upload your documents in PDF format remember to state your.

Fill up PIN Number and MyKad Number click Submit button. Obtaining an Income Tax Number. Register Online Through e-Daftar.

Click on Generate Form E for 2020. Go through the instructions carefully. Once you click on e-daftar head to PLT tab.

With Talenox Payroll you can submit Borang E in just 3 steps. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time. Internet Explorer 110 Microsoft Edge Mozilla Firefox.

First of all you need to register at the ezHASiL e-Filing website. According to Section 1121 of the Income Tax Act 1967 an individual can be imprisoned up to six months or fined up to RM2000 whenever he or she fails to furnish an income tax return form. 2 however you can only upload registration certificate and LLP current profile ONCE and in JPEG format.

Head over to Payroll Payroll Settings Form E. Settle all unpaid taxes within 7 months from the end of the companys financial year. Go through the instructions carefully.

Login to e-filing website. How Can I Open Income Tax Account In Malaysia. You must be wondering how to start filing income tax for the.

Make sure to scan the front so your name and IC. The file size also must be between 40k and 60k and the file name must be in alphanumeric only. We highlight the personal income tax rate for foreigners and expats how to get your income tax number from Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board of Malaysia and more importantly.

Pay tax instalments if a profit is forecasted in the coming year. How to Register a tax file in Malaysia. Yes you can still file your income tax manually in Malaysia.

Income generated from freelancing reviews brand endorsements and social media promotion are subject to income tax as stated by The Inland Revenue Board of Malaysia Lembaga Hasil Dalam Negeri LHDN. Browse to ezHASiL e-Filing website and click First Time Login. Visit the official Inland Revenue Board of Malaysia website.

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM.

What Really Happens If You Don T File Your Taxes

Difference Between Resident And Nri Fixed Deposit India Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

Pin By Uncle Lim On G Newspaper Ads Merry Christmas And Happy New Year Merry Christmas Happy New

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Income Tax Return Itr Filing Want To Change Your Bank Account Number In Your Itr Here S What You Should Do Zee Business

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

How To Register As A Taxpayer For The First Time In 2022

Taxes 2022 Should You File Early This Year Gobankingrates

When And Where To File Your Tax Return In 2018

Top Ten Mistakes To Avoid When E Filing Form 2290 Online For Ty 2020 21 Irs Forms Employer Identification Number Irs

The Irs 1040 Hotline Is Answering Only 1 Out Of Every 50 Calls The Washington Post

Don T Normally File A Tax Return You May Be Due A Credit A Refund Nonetheless

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

How To File Your Taxes For The First Time

When Can You File Your Taxes This Year Kiplinger